Introduction

Project finance is a specialized financing technique used to fund large-scale, capital-intensive projects such as power plants, water desalination facilities, real estate developments, and transportation infrastructure. It is a long-term financing approach that relies on the project's cash flows as the primary source of repayment, rather than the project sponsors' corporate balance sheets. This article will provide a detailed overview of project finance, its structure, phases, and how it differs from traditional corporate finance.

What is Project Finance?

Project finance involves the creation of a Special Purpose Company (SPC) or Special Purpose Vehicle (SPV), which is a legally separate entity formed specifically to design, build, and operate a particular project. The SPC is the borrower, and the project's assets and cash flows serve as collateral for the lenders. Key characteristics of project finance include:

- Long-term financing: Project finance deals typically have a duration ranging from 7 to 40 years, with financing tenors spanning 5 to 25 years.

- High leverage: Debt financing can range from 60% to 80% of the total project cost, resulting in a high leverage ratio.

- Non-recourse or limited recourse financing: Lenders have a limited claim on the project's assets and cash flows, with minimal or no recourse to the sponsors' other assets.

- Large-scale projects: Project finance is typically used for large-scale projects that require substantial debt and equity financing.

Corporate Finance vs. Project Finance

While corporate finance focuses on financing a company's operations and multiple projects, project finance is dedicated to a single, large-scale project. The key differences between the two include:

- Project finance concentrates on the financial, legal, and technical due diligence of the specific project, while corporate finance evaluates the overall financial strength of the company.

- Project finance equity is issued with a finite time horizon, whereas corporate finance equity has an indefinite time horizon.

- Project finance structures are complex and tailored to the project, while corporate finance structures are relatively simpler and more standardized.

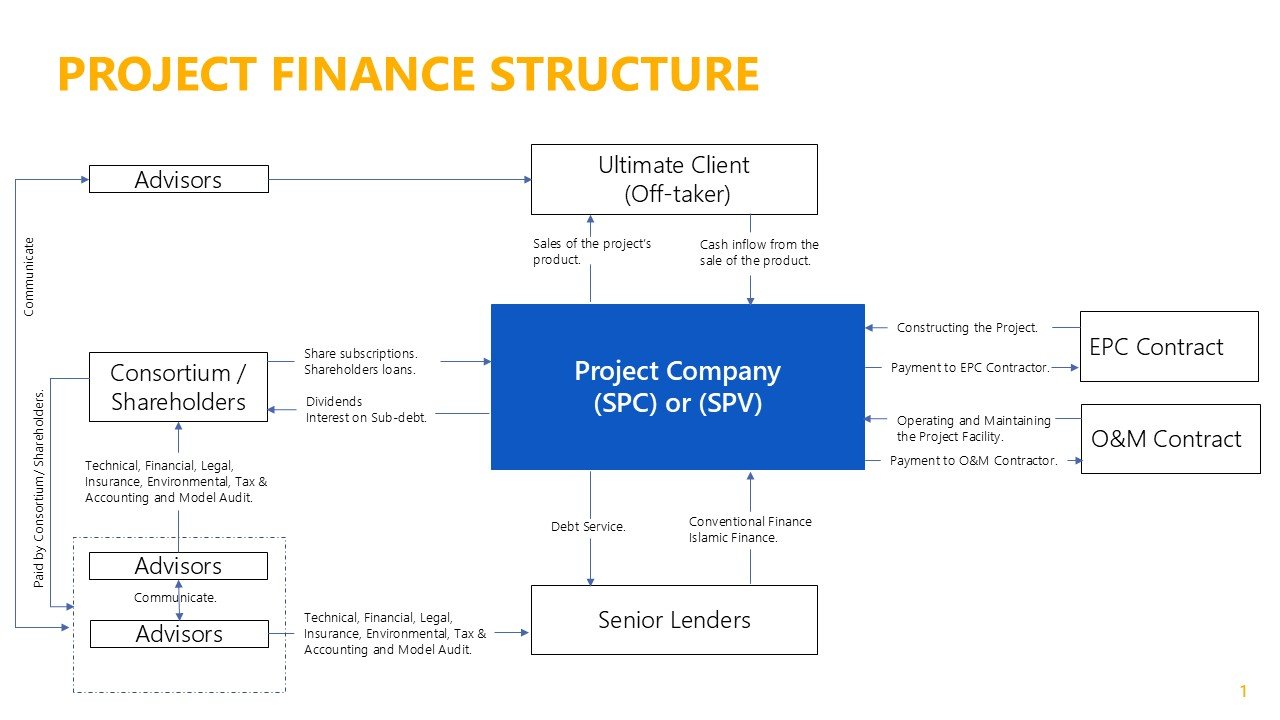

Project Finance Structure

The project finance structure involves various stakeholders, including the project company (SPC/SPV), sponsors/shareholders, senior lenders, contractors (EPC and O&M), off-takers (ultimate clients), and advisors. The key components of the structure are:

- Project Company (SPC/SPV): The borrower entity responsible for the project's development, construction, and operation.

- Sponsors/Shareholders: Entities that provide equity capital and subordinated debt to the project company.

- Senior Lenders: Financial institutions that provide debt financing, typically secured by the project's assets and cash flows.

- Contractors: Engineering, Procurement, and Construction (EPC) contractors and Operation and Maintenance (O&M) contractors responsible for project construction and operation, respectively.

- Off-takers: Entities that purchase the project's products or services, generating the cash inflows for debt servicing and equity returns.

- Advisors: Technical, financial, legal, insurance, environmental, tax, accounting, and model audit advisors who provide expert guidance throughout the project's lifecycle.

Project Finance Phases

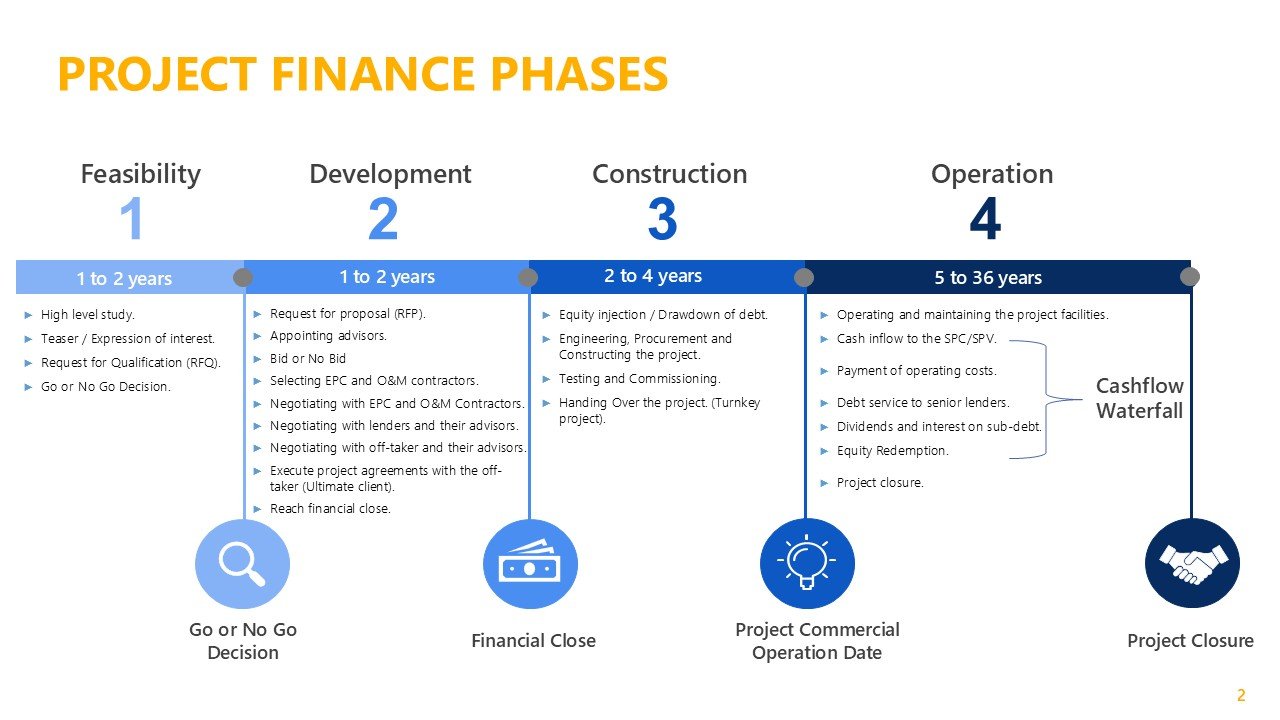

A project finance transaction progresses through four distinct phases, each with specific milestones and activities:

Phase 1: Feasibility (1 to 2 years)

The feasibility phase is the initial assessment stage where the project's viability is evaluated:

- High level study

- Teaser / Expression of interest

- Request for Qualification (RFQ)

- Go or No Go Decision

Phase 2: Development (1 to 2 years)

The development phase involves structuring the project and reaching financial close:

- Request for Proposal (RFP)

- Appointing advisors

- Bid or No Bid decision

- Selecting EPC and O&M contractors

- Negotiating with EPC and O&M contractors

- Negotiating with lenders and their advisors

- Negotiating with off-taker and their advisors

- Execute project agreements with the off-taker (Ultimate client)

- Reach financial close

Phase 3: Construction (2 to 4 years)

The construction phase covers the physical development and commissioning of the project:

- Equity injection / Drawdown of debt

- Engineering, Procurement and Constructing the project

- Testing and Commissioning

- Handing Over the project (Turnkey project)

Phase 4: Operation (5 to 36 years)

The operation phase is the longest phase, where the project generates cash flows through a cashflow waterfall mechanism:

- Operating and maintaining the project facilities

- Cash inflow to the SPC/SPV

- Payment of operating costs

- Debt service to senior lenders

- Dividends and interest on sub-debt

- Equity Redemption

- Project closure

Conclusion

Project finance is a powerful and structured approach to funding large-scale infrastructure and energy projects. By ring-fencing project risks within a Special Purpose Vehicle and relying on the project's own cash flows for debt repayment, it enables sponsors to undertake capital-intensive ventures while limiting their corporate exposure. Understanding the key phases, stakeholders, and financing structures is essential for any financial professional involved in infrastructure development and investment.

Chief Financial Officer & CPA. Empowering financial professionals with tools, knowledge, and resources to excel.

Stay Updated

Get the latest tutorials and articles delivered to your inbox.

No spam, ever. Unsubscribe anytime.